This post is the main article for the Incentives for EV Charger Installation series of articles.

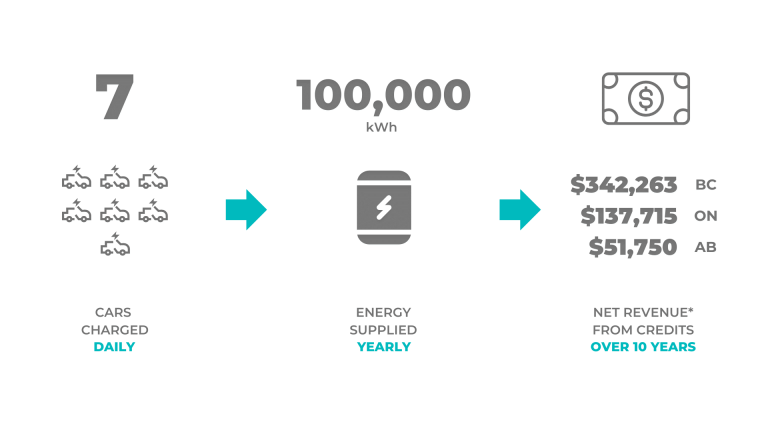

Below, you can view different earnings across different Canadian provinces.

Clean Fuel credits are incentives for EV charger installations in Canada. By installing and operating electric vehicle (EV) chargers in Canada, you earn revenue by generating and selling Clean Fuel credits from the amount of energy used to charge the batteries in battery electric vehicles.

Clean Fuel credits are government-regulated financial instruments. The buyers of credits (such as fossil fuel producers for vehicles) are mandated to either purchase credits or pay more expensive carbon prices on emissions. The revenue from credit sales pay you back the investment from site hosts (such as land owners, fleet operators, etc.) or charger network operators who have installed EV chargers.

The amount of money you earn is dependent on several factors, such as the charge site’s provincial jurisdiction, the class of EVs you are charging, the total amount of energy supplied, and the agreed credit price.

Because there are so many variables, we are releasing a series of use cases by province.

Clean Fuel credit: two types you can generate

Clean Fuel credit is an umbrella-term that Rewatt is using for the following two credit types in Canada:

- CFR credit: a credit that is traded on the Canadian federal Clean Fuel Regulation carbon market. This is a Canada-wide, and will start trading on July 1, 2023.

- BC LCFS credit: a credit that is traded on the British Columbia Low-Carbon Fuel Standard market. This is BC only, and is already trading.

A single Clean Fuel credit is a permit to emit one metric ton of greenhouse gases. It is a financial instrument that is purchased and sold.

How do you earn incentives from credits?

You generate clean fuel credits by supplying electricity to charge electric vehicles. The volume of credits generated depends mostly on the province the chargers are in.

Through a broker like Rewatt, these credits are sold on the Clean Fuel markets to the highest/best offer. The federal Canadian and provincial BC governments mandate that fossil fuel producers either pay for emissions at the carbon price or purchase Clean fuel credits: most choose credits because they are cheaper.

What is the governments' motive behind credits?

There is a motive behind these incentives for EV charger installations in Canada. The Canadian and BC governments believe that if there are lots of EV chargers in Canada, then citizens will purchase battery electric cars because range anxiety is reduced. Since transportation is the #1 or #2 source of Canadian emissions, then increasing the number of battery electric cars will significantly reduce emissions.

Earnings from credits by province

It is difficult to quantify what 100,000 kWh is equivalent to. As a result, we have listed a few real-world examples at this post.

Why do you earn different amounts in different provinces for the same amount of energy supplied?

The number of credits you can produce depends mainly on the province where the charging site is situated. The calculation is determined by the grid carbon intensity of that province. For the same amount of energy supplied to EVs, provinces that supply electricity from cleaner sources produce more credits, while provinces that rely on fossil fuels for electricity production generate fewer credits.