This post is the main article for the Incentives for EV Charger Installation series of articles.

You can go to the main article to view earnings in different Canadian provinces.

Use-Case: BC

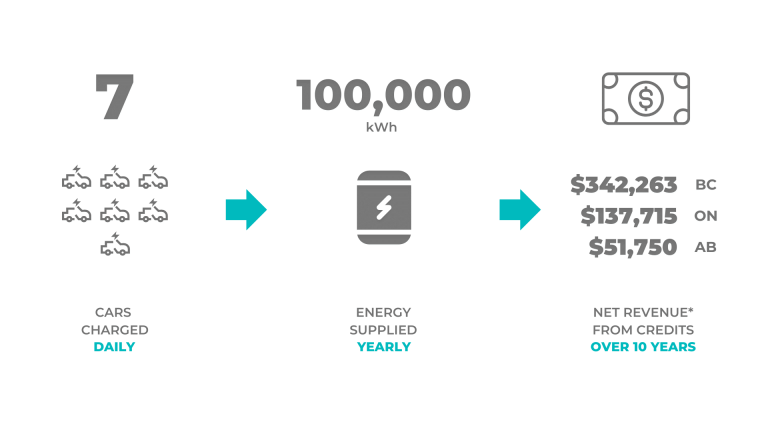

For 100,000 kWh of energy supplied per year for five years

It is difficult to quantify what 100,000 kWh is equivalent to. As a result, we have listed a few real-world examples at this post.

| Heavy-Duty | Light-Duty | Marine | |

|---|---|---|---|

| Number of BC LCFS credits over 5 years | 370 | 440 | 440 |

| BC LCFC Credit Price (conservative estimate) | $300.00 | $300.00 | $300.00 |

| Displaced fuel type (BC only) | Diesel | Gasoline | Gasoline |

| Number of CFR Credits over 5 years | 766 | 623 | 467 |

| CFR Credit Price (conservative estimate) | $150.00 | $150.00 | $150.00 |

| Gross Revenue over 5 years | $225,900 | $225,450 | $202,050 |

| Gross Revenue over 10 years | $443,850 | $444,750 | $399,000 |

| Transaction and Admin Fees* | 25 to 10%, sliding scale by volume | 25 to 10%, sliding scale by volume | 25 to 10%, sliding scale by volume |

| NET REVENUE per year | $33,000.00 to $40,000.00 |

$33,000.00 to $40,000.00 |

$29,000.00 to $36,000.00 |

| NET REVENUE over 5 years | $169,425.00 to $203,310.00 |

$169,087.00 to $202,905.00 |

$151,537.50 to $181,845.00 |

| NET REVENUE over 10 years (with renewal) | $350,257.50 to $399,465.00 |

$342,262.50 to $400,275.00 |

$299,250.00 to $359,100.00 |

Why can you potentially earn more credits in BC from EV chargers?

If you read our previous article, a Clean Fuel credit is an umbrella term we use for two types of credits: BC LCFC and Canada CFR. BC is the only province that allows you to generate two types of Clean Fuel credits at the same time.

The province of British Columbia already has a Low Carbon Fuel Standard (LCFS) credit market in operation. Credits are being sold at more than $400 per credit.

By adding the new Canada CFR credit market, EV chargers in BC can be used to generate CFR and BC LCFS credits at the same time. This is unusual as this allows for “credit stacking”, and this generates nearly twice the revenue.

So far, the BC government seems to allow the practice of credit stacking; however, they can choose to phase out the practice if EV chargers are everywhere (which is not the case at the moment). The BC government reserves the right to approve or reject projects to earn LCFS credits.

Basically, you should take advantage right now since there is a serious lack of charging infrastructure. These kind of credit markets start to wind down when people stop worrying about EV charging (similar to how we don’t worry about finding gas stations).

The revenue is linearly proportional to the energy supplied. If a charge site supplies 10 times more energy than 100,000 kWh, then it’s a good estimate that it will earn 10x more gross revenue.

*Transaction and administrative fees: As with all regulated carbon markets, credits must be verified by a 3rd party auditor, which adds significant costs. However, Rewatt’s model is to work on a sliding fee schedule based on an organization’s volume. This is most beneficial for fleets or network operators.