This post is the main article for the Incentives for EV Charger Installation series of articles.

You can go to the main article to view earnings in different Canadian provinces.

Use Case: Alberta

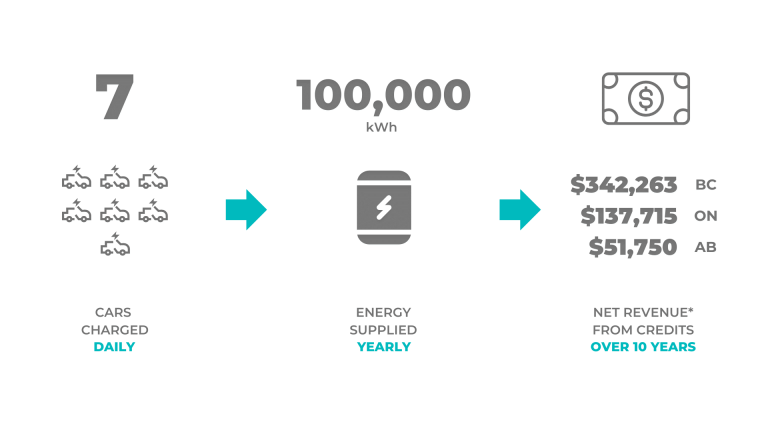

For 100,000 kWh of energy supplied per year

It is difficult to quantify what 100,000 kWh is equivalent to. As a result, we have listed a few real-world examples at this post.

| Heavy-Duty | Light-Duty | Marine | |

|---|---|---|---|

| Number of CFR Credits per year (avg.) | 72 | 45 | 15 |

| Number of CFR Credits over 5 years | 395 | 253 | 95 |

| Number of CFR Credits over 10 years | 735 | 460 | 155 |

| CFR Credit Price (conservative estimate) | $150/credit | $150/credit | $150/credit |

| GROSS REVENUE per year (avg.) | 10,812 | 6,725 | $2,187 |

| Transaction and Admin Fees* | 25 to 10%, sliding scale by volume | 25 to 10%, sliding scale by volume | 25 to 10%, sliding scale by volume |

| NET REVENUE per year (avg.) | $8,109.38 – $9,730.80 | $5,043.75 – $6,052.50 | $1,640.63 – $1,968.30 |

| NET REVENUE over 5 years | $44,437.50 – $53,325.00 | $28,462.50 – $34,155.00 | $10,687.50 – $12,825.00 |

| NET REVENUE over 10 years | $82,687.50 – $99,225.00 | $51,750.00 – $62,100.00 | $17,437.50 – $20,925.00 |

*Transaction and administrative fees: As with all regulated carbon markets, credits must be verified by a 3rd party auditor, which adds significant costs. However, Rewatt’s model is to work on a sliding fee schedule based on an organization’s volume. This is most beneficial for fleets or network operators.