On July 1, 2023, the financing of public electric car (EV) chargers will change across Canada. The federal government of Canada has created a regulated carbon market based on the Canadian Clean Fuel Regulations (CFR).

If you’re a network operator or site host of public electric-vehicle charger, you can generate Canadian CFR credits for electric vehicle chargers (“CFR credits”) to accelerate the construction of EV chargers across Canada. This is in addition to the existing BC LCFS credits, which you can stack with CFR credits. Together, you call these Clean Fuel credits.

This article will serve as the introduction to this topic as we dive into the subject in further articles.

Clean Fuel credit: Definition for an umbrella-term

A single Clean Fuel credit is a permit to emit one metric ton of greenhouse gases.

Clean Fuel credit is an umbrella-term that is Rewatt is using for the following two credit types in Canada:

- CFR credit: a credit that is traded on the Canadian federal Clean Fuel Regulation carbon market. This is a Canada-wide, and will start trading on July 1, 2023.

- BC LCFS credit: a credit that is traded on the British Columbia Low-Carbon Fuel Standard market. This is BC only, and is already trading.

How do I generate Clean Fuel credits?

As a charger network operator or site host, a charging site generates Clean Fuel credits depending on the total energy used to charge EVs during a period. It doesn’t matter how many chargers are installed. Here’s what matters:

- The province where the charge site is installed

- The vehicle type (light-duty, heavy-duty, or marine)

- The total amount of electric energy used to charge each vehicle type over a year

- OR, the number of EVs by each vehicle type and the total distance driven by each vehicle type over a year

- The price of credits in BC and/or Canada

- Displacing gasoline or diesel (BC only)

How do Clean Fuel credits get bought and sold in a carbon market?

In any market, there are buyers and sellers. Here’s how it works.

The buyers of Clean Fuel credits are fuel-producing companies, such as oil and gas producers. The federal government mandated for buyers to participate in the Clean Fuel credit market. If the method by which their fuel is produced exceeds certain limits, they shall pay the regulated carbon price (most expensive) or buy Clean Fuel credits (cheaper).

The sellers are generators of Clean Fuel credits (see above section. The regulations also deal with hydrogen, biofuels, and more, but for this audience, we’re sticking to EV chargers).

A seller or its broker offers the buyer Clean Fuel credits for sale. The buyers compete with each other to get the best price for these Clean Fuel credits.

When a price is agreed upon, then a sales transaction is made between the buyer and the seller. If there is a broker, then there is a transaction fee. In a compliance carbon market, a 3rd party auditor verifies the validity of the carbon credits (which adds significant costs).

In general, the buyers are funding the charge sites using Clean Fuel credits.

What's the purpose?

In 2020, the transport sector was the second largest source of greenhouse gas emissions, accounting for 24% of total national emissions with 159 million metric tons. To get to zero, the logic is that people and organizations will be more comfortable buying EVs if there are more chargers available. More EVs means less emissions.

The Canadian federal government is driving this change. They have chosen to work within the economic system with different ways to change behaviour through financial incentives (e.g. grants), penalties (e.g. tax), and a mix of both (e.g. regulated carbon market). The Clean Fuel credit market has buyers funding the development of charge sites, which enables buyers to create flexible and creative financial solutions. On the flip side, active government regulation is required such that emissions reduction targets remains the focus and are not greenwashed.

For Clean Fuel credits, does it matter where the charge site is operating?

Yes, location matters. A lot.

The energy output from a charge site in a province with a cleaner electric grid (such as Manitoba, Quebec, PEI) will generate more Clean Fuel credits (and more money) than a one that is in a grid with mostly fossil fuel sources (Alberta, Saskatchewan, Nova Scotia, Nunavut ). For example, the grid carbon intensity (gCO2e/MJ) is 7 in Manitoba, 11 in BC, and 14 in Ontario. In Alberta, it is 218 because it doesn’t enjoy a majority energy source from hydro-electric or nuclear power.

For the same amount of energy outputted, a charge site in Manitoba will generate 2.4X more credit revenue than in Alberta.

BC is a special case. See the next section.

Why can you earn more from Clean fuel credits in BC?

The province of British Columbia has an existing Low Carbon Fuel Standard (LCFS) credit market in operation.

Here’s what’s exciting: to create even more incentive, the total energy output to charge EVs can be used to generate both CFR and BC LCFS credits at the same time. This is unusual as this allows for “credit stacking”.

As a result, a charge site in BC will generate 5.76X more revenue from credits than in Alberta, using a mix of CFR and BC LCFS credits.

For reference, the price of BC LCFS credits are more than $400/credit. For CFR credits, the price is estimated to start at $150/credit. The credits are calculated differently. We will release more case studies.

Network Operator or Site Host: Which are you, and why it matter

First, determine if you are network operator for a charge site. If you are definitely not, then determine if you are a site host. For each charge site, only one party claims ownership of Clean Fuel credits: ensure that credit ownership is clear on your contracts.

- The network operator is a person/organization who “operates a communication platform that collects data on the electricity supplied by a charging station and who is the owner of that data”.

- The site host is a person/organization who “owns or leases a charging station and who has the legal right to have the charging station installed”.

Why this matters:

- Site hosts keep the revenue earned from Clean Fuel credits.

- Network operators must use all revenue from the sale of Clean Fuel credits within 2 years (730 days) of the sale/transfer date, for the purpose of carrying out, in Canada, either or both of the following activities:

- Expanding electric vehicle charging infrastructure, including charging stations and electricity distribution infrastructure that supports electric vehicle charging, whether intended primarily for use by the occupants of a private dwelling-place or the public; or

- reducing the cost of electric vehicle ownership through financial incentives to purchase or operate an electric vehicle.

- In our interpretation, you cannot be both a network operator and site host for a site. If you fit both descriptions, then you are a network operator first.

- Logically, it possible to be a site host for one site and network operator for another site, although this doesn’t really make sense business-wise.

How long can you earn Clean Fuel credits for?

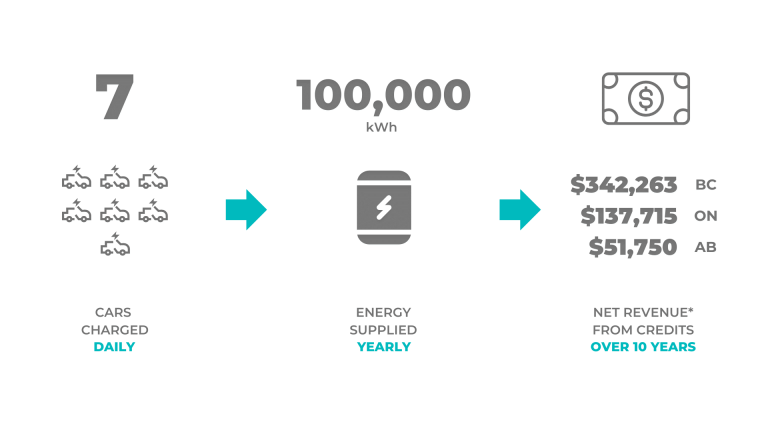

You earn Clean Fuel credits for up to 10 years per charge site. For Rewatt, we are planning to offer five-year terms since 10 years seems like a long time.

Will Clean Fuel credits go away?

Yes, one day they will, which will be a good day. The purpose of credits is to incentive behaviour change through financial means. Thus, Clean Fuel credits will lose their value when most people and businesses are purchasing electric vehicles and there are enough public EV chargers.