The Five Stages of Carbon Credits Creation

Written by Prageet Nibber

How does carbon credits creation work? And what’s involved? We’re going to answer these questions.

Environmental credits are growing rapidly in popularity around the world as governments, citizens and companies look for ways to lower their carbon footprints. Credits such as carbon offsets and renewable energy certificates (RECs) are an increasingly important source of funding for climate action projects. Everyone from individual homeowners to municipalities to large corporations can leverage these assets to improve their revenue streams and take climate action.

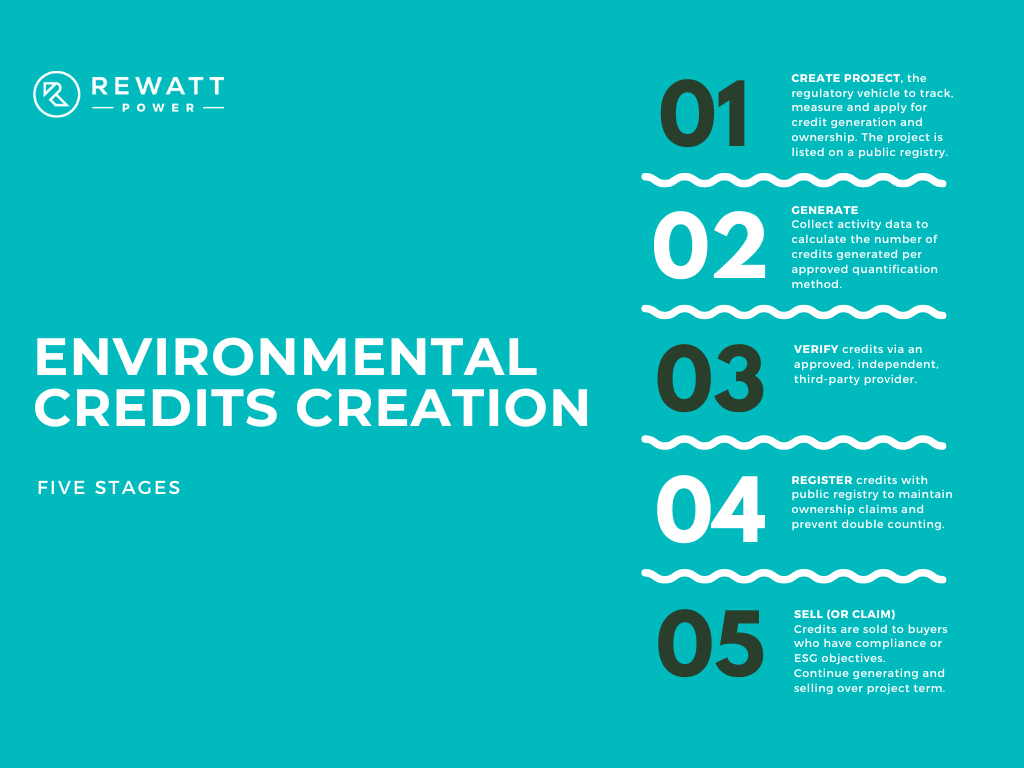

For individuals who are not experts in this field, environmental or carbon credits creation can be daunting. There are many strategies, standards, auditors, registries, and rules to consider and these factors and their associated costs are both important and vary by credit type and geography. Thankfully, despite the differences, most credits still undergo the same five stages to be created: create project, generate, verify, register and sell. These steps are easy to understand.

Step 1: Create Project

Before you start, you have already defined the activity producing the credits (e.g. renewable energy generation for emissions avoidance) and have determined where the credits will be registered.

The first step in creating an environmental credit is to create your “project” – the regulatory vehicle used to track, measure and apply for credits with the regulators. You need to create this project first before you can start generating credits.

Creating a project generally involves defining its scope, nature and estimating its potential impact according to established practices and methodologies (i.e. your “project plan”). Different credit systems have different requirements. In general, however, this process is paperwork intensive. It also tends to require a submission fee with regulators. For example, in Alberta, the cost is $500 to set up a project with Alberta Carbon Registries. Traditionally, individual organizations choose to work with consultants to create their projects given the technical expertise required. Others choose to work with financial technology companies (like Rewatt Power) who aggregate individuals and organizations into collective projects to share costs and negotiate better terms and pricing.

The project is deemed “created” when the project is listed on a public registry where credit generation and ownership will be tracked.

Step 2: Generate

Once your project has been created, it’s time to run the operations on which you will receive credits. For example, if you own a solar farm, it’s time to generate solar power and connect it to the electrical grid. Afterwards (or sometimes concurrently) the impact of these operations are reported and then quantified. The ultimate goal of this stage is to determine how many credits you are entitled to create.

Gathering and quantifying the data you need can be complicated. How you must report and quantify data is highly dependent on what kind of credit you are producing and your regulatory zone. For example, creating a Low Carbon Fuel Standard Credit (LCFS) in British Columbia is quantitatively prescriptive: an excel spreadsheet is provided in which your calculations must be made. Other systems, like Alberta, specify what formulas must be used but no specific tools are provided. Knowing which tools need to be used and how can take time. Consultants or in-house specialists are also often used in this phase because of the technical expertise required. Alternatively, financial technology can be used to automatically record and quantify data that is highly measurable and reliable, such as energy generation.

Ultimately, the point of the generation phase is “proving the emissions reductions happened as described in the project plan.”

Once calculations are complete and the evidence is collected, it’s time to bring in the independent third-party verifier.

Step 3: Verify

The next step is to verify. Verification is a process by which an approved, independent, third-party provider ensures that the claims you make in your project application are legitimate. This practice is similar in principle to accounting firms signing off on financial statements of public companies. Regulators want to know that your project has actually produced the impact you are claiming it has – that it has truly earned the credits which you are attempting to create and sell. Regulators dictate which organizations are allowed to provide this service.

Third party auditors investigate whether important carbon accounting principles are being upheld and therefore provide an essential service in the carbon offset world. For example, they evaluate whether your project is truly additional and whether risks of double counting and leakage have been mitigated. All of this work is critical in establishing public trust and protecting against greenwashing.

Once the third-party provider has reviewed your submission and signed off on it (usually via a letter) then you are ready to submit your claims to the registry. This verification step can take weeks to months to complete and cost thousands of dollars.

Step 4: Register

After all this work is complete, it’s finally time to register your credits. Registries are public institutions that maintain environmental credit ownership records. To trade your credits, you need to submit them to the appropriate registry, where they will be serialized and assigned a unique identification number (UIN). UIN numbers are important because they help track ownership claims and prevent double counting.

There are two kinds of registries: compliance and voluntary. Compliance registries house and track “compliant” credits, meaning that organizations can use these credits to meet their legal carbon footprint obligations. Voluntary registries house and track “voluntary” credits, meaning that organizations can use these credits to achieve non-compliant and voluntary objectives, such as ESG goals. In general, the requirements for creating compliance credits are higher, as is the market price they command.

Serialization typically requires a fee. Once this step has been completed, your credits are ready for sale.

Step 5: Sell (or Claim)

The final stage within this process is the sale. Typically, environmental credit transactions are brokered through bi-lateral deals via professional brokers. While public exchanges and platforms are growing in popularity, the bulk of the transactions for carbon offsets and renewable energy certificates (RECs) still appear to occur between parties who were brought together by a traditional middleman. Alternatively, you may elect to “retire” your credits (i.e. claim them to reduce your carbon footprint).

Like other assets, every time a credit is bought or sold the change of ownership must also be recorded on the registry (for another fee).